UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant þ

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement | |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| þ | Definitive Proxy Statement | |

| ¨ | Definitive Additional Materials | |

| ¨ | Soliciting Material Pursuant to §240.14a-12 | |

LAM RESEARCH CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| þ | No fee required. | |||

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid:

| |||

| ¨ | Fee paid previously with preliminary materials. | |||

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

| |||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| (3) | Filing Party:

| |||

| (4) | Date Filed:

| |||

September 24, 201329, 2016

Dear Lam Research Stockholders,

We cordially invite you to attend, in person or by proxy, the Lam Research Corporation 20132016 Annual Meeting of Stockholders. The annual meeting will be held on Thursday,Wednesday, November 7, 2013,9, 2016, at 9:30 a.m. pacific standard timePacific Standard Time in the Building CA1 Auditorium at the principal executive offices of Lam Research Corporation, which is located at 4650 Cushing Parkway, Fremont, California 94538.

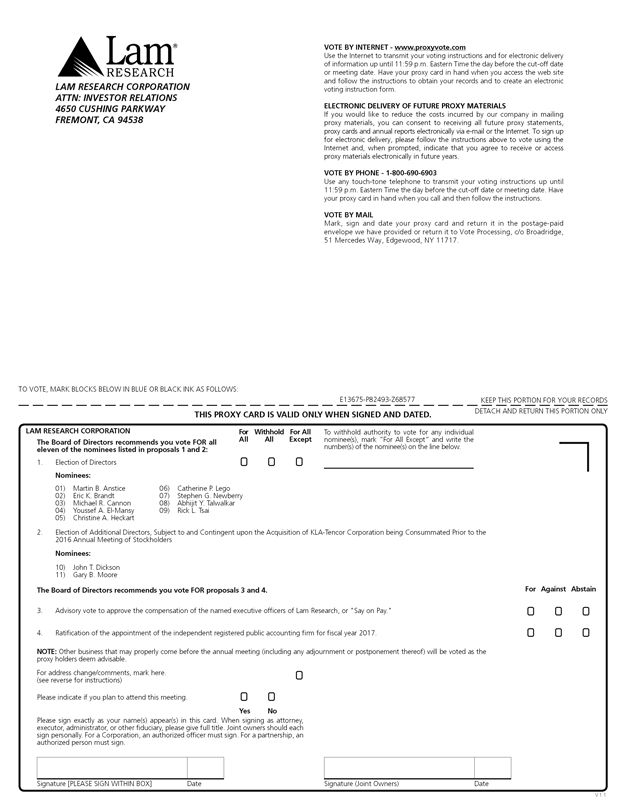

At this year’s annual meeting, stockholders will be asked to elect the nine nominees named in the attached proxy statement as directors to serve foruntil the ensuing year,next annual meeting of stockholders, and until their respective successors are elected and qualified,qualified; to elect the two additional nominees named in the attached proxy statement in connection with the acquisition of KLA-Tencor Corporation as directors, subject to and contingent upon the acquisition being consummated prior to the 2016 annual meeting of stockholders, to serve until the next annual meeting of stockholders, and until their respective successors are elected and qualified; to cast an advisory vote onto approve the compensation of our named executive officers, (“Sayor “Say on Pay”); and to ratify the appointment of the independent registered public accounting firm for fiscal year 2014.2017. The Board of Directors recommends that you vote in favor of all threefour proposals. Management will not provide a business update during this meeting; please refer to our latest quarterly earnings report for our current outlook.

Please refer to the proxy statement for detailed information about the annual meeting and each of the proposals, as well as voting instructions.Your vote is important, and we strongly urge you to cast your vote by the internet, phone or mail even if you plan to attend the meeting in person.

Sincerely yours,

Lam Research Corporation

Stephen G. Newberry

Chairman of the Board

Notice of of Stockholders

|

4650 Cushing Parkway

Fremont, California 94538

Telephone: 510-572-0200

| Date and Time | ||

| 9:30 a.m. Pacific Standard Time | ||

| Place | Lam Research Corporation | |

| Building CA1 Auditorium | ||

| 4650 Cushing Parkway | ||

| Fremont, California 94538 | ||

Items of Business

| 1. | Election of nine directors to serve |

| 2. | Election of two additional directors in connection with the acquisition of KLA-Tencor Corporation (“KLA-Tencor”), subject to and contingent upon the acquisition being consummated prior to the 2016 annual meeting of stockholders, to serve until the next annual meeting of stockholders, and until their respective successors are elected and qualified |

| 3. | Advisory vote |

| Ratification of the appointment of independent registered public accounting firm for fiscal year |

| Transact such other business that may properly come before the annual meeting (including any adjournment or postponement thereof) |

Record Date

Only stockholders of record at the close of business on September 9, 2013, or13, 2016, the “Record Date,” are entitled to notice of and to vote at the annual meeting.

Voting

Please vote as soon as possible, even if you plan to attend the annual meeting in person. You have three options for submitting your vote before the annual meeting: by the internet, phone or mail. The proxy statement and the accompanying proxy card provide detailed voting instructions.

Internet Availability of Proxy Materials

Our Notice of 20132016 Annual Meeting of Stockholders, Proxy Statement and Annual Report to Stockholders are available on the Lam Research website athttp://investor.lamresearch.comand atwww.proxyvote.com.

By Order of the Board of Directors

Sarah A. O’Dowd

Secretary

This proxy statement is first being made available and/or mailed to our stockholders on or about September 24, 2013.29, 2016.

LAM RESEARCH CORPORATION

Proxy Statement for 20132016 Annual Meeting of Stockholders

|

Information Concerning Solicitation and Voting

Our board of directors solicits your proxy forTo assist you in reviewing the 2013 Annual Meeting of Stockholders and any adjournment or postponement of the meeting, for the purposes described in the “Notice of 2013 Annual Meeting of Stockholders.” The table below shows important details aboutproposals to be acted upon at the annual meeting we call your attention to the following information about the proposals and voting. voting recommendations, the Company’s director nominees and highlights of the Company’s corporate governance, and executive compensation. The following description is only a summary. For more complete information about these topics please review the complete proxy statement.

We use the terms “Lam Research,” “Lam,” the “Company,” “we,” “our,” and “us” in this proxy statement to refer to Lam Research Corporation, a Delaware corporation.

Record DateFigure 1. Proposals and Voting Recommendations

Only stockholders of record at the close of business on September 9, 2013, or the “Record Date,”

| Voting Matters | Board Vote Recommendation | |||

| Proposal 1 – Election of Nine Nominees Named Herein as Directors | FOR each nominee | |||

| Proposal 2 – Election of Two Additional Nominees Named Herein, Subject to and Contingent Upon the Acquisition of KLA-Tencor Corporation (“KLA-Tencor”) Being Consummated Prior to the 2016 Annual Meeting of Stockholders, as Directors | FOR each nominee | |||

| Proposal 3 – Advisory Vote to Approve the Compensation of Our Named Executive Officers, or “Say on Pay” | FOR | |||

| Proposal 4 – Ratification of the Appointment of the Independent Registered Public Accounting Firm for Fiscal Year 2017 | FOR | |||

Figure 2. Summary Information Regarding Director Nominees

You are entitled to receive notice of and to vote at the annual meeting.

Shares Outstanding

162,092,907 shares of common stock were outstanding as of the Record Date.

Quorum

A majority of shares outstanding on the Record Date constitutes a quorum. A quorum is required to transact business at the annual meeting.

Inspector of Elections

The Company will appoint an inspector of elections to determine whether a quorum is present. The inspector will also tabulate the votes cast by proxy or at the annual meeting.

Effect of Abstentions and

Broker Non-Votes

Shares voted “abstain” and broker non-votes (shares held by brokers that do not receive voting instructions from the beneficial owner of the shares, and do not have discretionary authoritybeing asked to vote on a matter) will be counted as present for purposes of determining whether we have a quorum. For purposes of voting results, abstentions will not be counted with respect to the election of directors but will have the effectnine director nominees listed in the table below under the heading “Existing Director Nominees” and, subject to and contingent upon the acquisition of “no” votes with respectKLA-Tencor being consummated prior to other proposals, and broker non-votes will not be counted with respect to any proposal.

Voting by Proxy

Stockholders may vote by internet, phone, or mail, per the instructions on the accompanying proxy card.

Voting at the Meeting

Stockholders can vote in person during the meeting. Stockholders of record will be on a list held by the inspector of elections. Each beneficial owner (an owner who is not the record holder of their shares) must obtain a proxy from the beneficial owner’s brokerage firm, bank, or the stockholder of record holding such shares for the beneficial owner, and present it to the inspector of elections with a ballot. Voting in person by a stockholder as described here will replace any previous votes of that stockholder submitted by proxy.

Changing Your Vote

Stockholders of record may change their votes by revoking their proxies. This may be done at any time before the polls close by (a) submitting a later-dated proxy by the internet, telephone or mail, or (b) submitting a vote in person at the annual meeting. Before thethis year’s annual meeting of stockholders, the two additional director nominees listed under the subsequent heading “Additional Director Nominees.” The following table provides summary information about each director nominee as of record may also deliver voting instructions to our Secretary, Lam Research Corporation, 4650 Cushing Parkway, Fremont, California 94538. If a beneficial owner holds shares through a bank or brokerage firm, or another stockholderSeptember 13, 2016, and their biographical information is contained in the “Voting Proposals – Proposal No. 1: Election of record, the beneficial owner must contact the stockholderExisting Directors – 2016 Nominees for Director” and “Voting Proposals – Proposal No. 2: Election of record in order to revoke any prior voting instructions.Additional Directors – 2016 Nominees for Director” sections below.

Voting Instructions

If a stockholder completes and submits proxy voting instructions, the people named on the proxy card as proxy holders, or the “Proxy Holders,” will follow the stockholder’s instructions. If a stockholder submits proxy voting instructions but does not include voting instructions for each item, the Proxy Holders will vote as the board recommends on each item for which the stockholder did not include an instruction. The Proxy Holders will vote on any other matters properly presented at the annual meeting in accordance with their best judgment.

Voting Results

We will announce preliminary results at the annual meeting. We will report final voting results athttp://investor.lamresearch.com and in a Form 8-K to be filed shortly after the annual meeting.

Availability of Proxy Materials

This proxy statement and the accompanying proxy card and 2013 Annual Report will be mailed to stockholders entitled to vote at the annual meeting who have

| Director | Committee Membership | Other Current Public Boards | ||||||||||||

| Name | Age | Since | Independent (1) | AC | CC | NGC | ||||||||

| Existing Director Nominees | ||||||||||||||

| Martin B. Anstice | 49 | 2012 | No | |||||||||||

| Eric K. Brandt | 54 | 2010 | Yes | C/FE | Yahoo!, Dentsply Sirona | |||||||||

| Michael R. Cannon | 63 | 2011 | Yes | M | M | Seagate Technology, Dialog Semiconductor | ||||||||

| Youssef A. El-Mansy | 71 | 2012 | Yes | M | ||||||||||

| Christine A. Heckart | 50 | 2011 | Yes | M | ||||||||||

| Catherine P. Lego | 59 | 2006 | Yes | C | M | Fairchild Semiconductor, IPG Photonics | ||||||||

| Stephen G. Newberry | 62 | 2005 | No | Splunk | ||||||||||

| Abhijit Y. Talwalkar | 52 | 2011 | Yes (Lead Independent Director) | M | C | |||||||||

| Lih Shyng (Rick L.) Tsai | 65 | 2016 | Yes | NXP Semiconductors, Chunghwa Telecom | ||||||||||

| Additional Director Nominees(2) | ||||||||||||||

| John T. Dickson | 70 | –(2) | Yes | QLogic | ||||||||||

| Gary B. Moore | 67 | –(2) | Yes | Finjan Holdings | ||||||||||

|

(2) Currently members of KLA-Tencor board of directors | ||

| AC – Audit committee | C– Chairperson | |

| CC – Compensation committee | M – Member | |

| NGC – Nominating and governance committee | FE – Audit committee financial expert (as determined based on SEC rules) |

designated a preference for a printed copy beginning on September 24, 2013. Stockholders who previously chose to receive proxy materials electronically were sent an email with instructions on how to access this year’s proxy materials and the proxy voting site.

We have also provided our stockholders access to our proxy materials over the internet in accordance with rules and regulations adopted by the United States Securities and Exchange Commission, or the “SEC.” These materials are available on our website athttp://investor.lamresearch.comand atwww.proxyvote. com. We will furnish, without charge, a printed copy of these materials and our 2013 Annual Report (including exhibits) on request by phone (510-572-1615), by mail (to Investor Relations, Lam Research Corporation, 4650 Cushing Parkway, Fremont, California 94538), or by email (toinvestor.relations@lamresearch.com).

A Notice of Internet Availability of Proxy Materials will be mailed beginning on September 24, 2013 to all stockholders entitled to vote at the meeting. The notice will have instructions for stockholders on how to access our proxy materials through the internet and how to request that a printed copy of the proxy materials be mailed to

them. The notice will also have instructions on how to elect to receive all future proxy materials electronically or in printed form. If you choose to receive future proxy materials electronically, you will receive an email each year with instructions on how to access the proxy materials and proxy voting site.

Proxy Solicitation Costs

The Company will bear the cost of all proxy solicitation activities. Our directors, officers and other employees may solicit proxies personally or by telephone, email or other communication means, without any cost to Lam Research. In addition, we have retained AST Phoenix Advisors to assist in obtaining proxies by mail, facsimile or email from brokers, bank nominees and other institutions for the annual meeting. The estimated cost of such services is $8,500 plus out-of-pocket expenses. AST Phoenix Advisors may be contacted at 6201 15th Avenue, 3rd Floor, Brooklyn, New York, 11219. We are required to request that brokers and nominees who hold stock in their names furnish our proxy materials to the beneficial owners of the stock, and we must reimburse these brokers and nominees for the expenses of doing so in accordance with statutory fee schedules.

Other Meeting InformationContinues on next page u

Annual Meeting Admission

All stockholders entitled to vote as of the Record Date are entitled to attend the annual meeting. Admission of stockholders will begin at 9:15 a.m. pacific standard time on November 7, 2013. Any stockholders interested in attending the annual meeting should be prepared to present government-issued photo identification, such as a valid driver’s license or passport, and verification of ownership of Company common stock or proxy status as of the Record Date for admittance. For stockholders of record as of the Record Date, proof of ownership as of the Record Date will be verified prior to admittance into the annual meeting. For stockholders who were not stockholders as of the Record Date but hold shares through a bank, broker or other nominee holder, proof of beneficial ownership as of the Record Date, such as an account statement or similar evidence of ownership, will be verified prior to admittance into the annual meeting. For proxy holders, proof of valid proxy status will also be verified prior to admittance into the annual meeting. Stockholders and proxy holders will be admitted to the annual meeting if they comply with these procedures. Information on how to obtain directions to attend the annual meeting and vote in person is available on the Lam Research website athttp://investor.lamresearch.com.

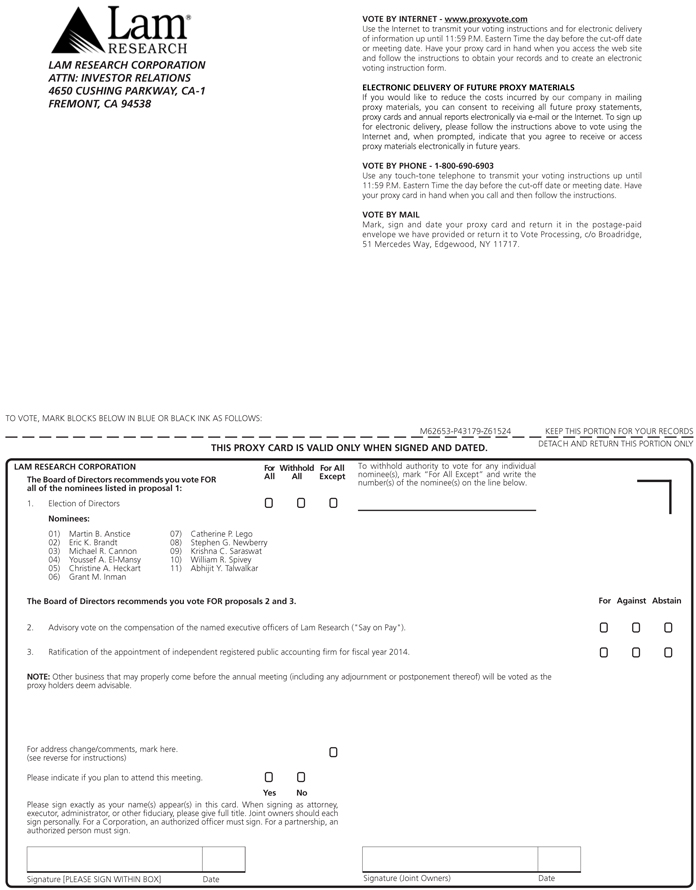

Voting on Proposals

Pursuant to Proposal No. 1, board members will be elected at the annual meeting to fill eleven seats on the board to serve for the ensuing year, and until their respective successors are elected and qualified, under a “majority vote” standard. The majority voting standard means that, even though there are eleven nominees for the eleven board seats, a nominee will be elected only if he or she receives an affirmative “for” vote from stockholders owning, as of the Record Date, at least a majority of the shares present and voted at the meeting in such nominee’s election by proxy or in person. If an incumbent fails to receive the required majority, his or her previously submitted resignation will be promptly considered by the board. Each stockholder may cast one vote (“for” or “withhold”), per share held, for each of the eleven nominees. Stockholders may not cumulate votes in the election of directors.

Each share is entitled to one vote on Proposals No. 2 and 3. Votes may be cast “for,” “against” or “abstain” on those Proposals.

If a stockholder votes by means of the proxy solicited by this proxy statement and does not instruct the Proxy Holders how to vote, the Proxy Holders will vote: “FOR” all individuals nominated by the board; “FOR” approval, on an advisory basis, of the compensation of our named executive officers; and “FOR” the ratification of Ernst & Young LLP as the Company’s independent registered public accounting firm for fiscal year 2014.

If you choose to vote in person, you will have an opportunity to do so at the annual meeting. You may either bring your proxy card to the annual meeting, or if you do not bring your proxy card, the Company will pass out written ballots to anyone who was a stockholder as of the Record Date. As noted above, if you are a beneficial owner (an owner who is not the record holder of their shares), you will need to obtain a proxy from your brokerage firm, bank, or the stockholder of record holding shares on your behalf.

Voting by 401(k) Plan Participants

Employee participants in Lam’s Savings Plus Plan, Lam Research 401(k) and the Novellus Systems, Inc. (“Novellus”) 401(k) Plan, or the “401(k) Plans,” who held Lam common stock in their personal 401(k) Plan accounts as of the Record Date will receive this proxy statement, so that each participant may vote, by proxy, his or her interest in Lam’s common stock as held by the 401(k) Plans. The 401(k) Plan trustees, or the Company’s Savings Plus Plan, Lam Research 401(k) Committee as the administrator of the 401(k) Plans, will aggregate and vote proxies in accordance with the instructions in the proxies of employee participants that they receive.

Stockholder Accounts Sharing the Same Last Name and Address

To reduce the expense of delivering duplicate proxy materials to stockholders who may have more than one account holding Lam Research stock but who share the same address, we have adopted a procedure approved by the SEC called “householding.” Under this procedure, stockholders of record who have the same address and last name will receive only one copy of our proxy statement and annual report unless one of the stockholders notifies our investor relations department that he or she wants to receive separate copies. This procedure reduces duplicate mailings and therefore saves printing and mailing costs, as well as natural resources. Stockholders who participate in householding will

continue to have access to all proxy materials athttp://investor.lamresearch.com, as well as the ability to submit separate proxy voting instructions for each account through the internet or by phone.

Stockholders holding multiple accounts of Lam common stock may request separate copies of the proxy materials by contacting us by phone (510-572-1615), by mail (to Investor Relations, Lam Research Corporation, 4650 Cushing Parkway, Fremont, California 94538) or by email (toinvestor.relations@lamresearch.com). Stockholders may also request consolidation of proxy materials mailed to multiple accounts at the same address.

Stockholder-Initiated Proposals and Nominations for 2014 Annual Meeting

Proposals submitted under SEC rules for inclusion in the Company’s proxy statement. Stockholder-initiated proposals (other than director nominations) may be eligible for inclusion in our proxy statement for next year’s 2014 annual meeting (in accordance with SEC Rule 14a-8) and for consideration at the 2014 annual meeting. The Company must receive a stockholder proposal no later than May 27, 2014 for the proposal to be eligible for inclusion. Any stockholder interested in submitting a proposal or nomination is advised to contact legal counsel familiar with the detailed securities law requirements for submitting proposals or nominations for inclusion in a company’s proxy statement.

Proposals and nominations under Company bylaws. Stockholders may also submit proposals for consideration, and nominations of director candidates for election, at the annual meeting by following certain requirements set forth in our bylaws. The current applicable provisions of our bylaws are described below. Proposals will not be eligible for inclusion in the Company’s proxy statement unless they are submitted in compliance with then applicable SEC rules; however, they will be presented for discussion at the annual meeting if the requirements established by our bylaws for stockholder proposals and nominations have been satisfied. Under current SEC rules, stockholder nominations for directors are not eligible for inclusion in the Company’s proxy materials.

Our bylaws establish requirements for stockholder proposals and nominations to be discussed at the annual meeting even though they are not included in our proxy statement. Assuming that the 2014 annual meeting takes place at roughly the same date next year as the 2013 annual meeting (and subject to any change in

Lam Research Corporation | 1 |

Figure 3. Corporate Governance Highlights

| Board and Other Governance Information(1) | As of September 13, 2016 | |||

| Size of Board as Nominated | 9 | (2) | ||

| Average Age of Director Nominees | 58.3 | (3) | ||

| Average Tenure of Director Nominees | 5.96 | (4) | ||

| Number of Independent Nominated Directors | 7 | (5) | ||

| Number of Nominated Directors Who Attended <75% of Meetings | 0 | |||

| Number of Nominated Directors on More Than Four Public Company Boards | 0 | (6) | ||

| Directors Subject to Stock Ownership Guidelines | Yes | |||

| Annual Election of Directors | Yes | |||

| Voting Standard | Majority | |||

| Plurality Voting Carveout for Contested Elections | Yes | |||

| Separate Chairman and Chief Executive Officer (“CEO”) | Yes | |||

| Lead Independent Director | Yes | |||

| Independent Directors Meet Without Management Present | Yes | |||

| Board (Including Individual Director) and Committee Self-Evaluations | Yes | |||

| Annual Independent Director Evaluation of CEO | Yes | |||

| Risk Oversight by Full Board and Committees | Yes | |||

| Commitment to Board Refreshment and Diversity | Yes | |||

| Robust Director Nomination Process | Yes | |||

| Board Orientation/Education Program | Yes | |||

| Code of Ethics Applicable to Directors | Yes | |||

| Stockholder Ability to Act by Written Consent | Yes | |||

| Poison Pill | No | |||

| Publication of Corporate Social Responsibility Report on Our Website | Yes | |||

| (1) | The table reflects board information relating to the nine director nominees in proposal number one. Corresponding information adjusted for the two additional director nominees from the KLA-Tencor board in proposal number two is reflected in any related footnotes. |

| (2) | The size of the board as nominated is 11 if adjusted for the two additional nominees from the KLA-Tencor board in proposal number two. See “Voting Proposals – Proposal No. 1: Election of Existing Directors –Board Size” for additional information regarding the board size. |

| (3) | The average age of the director nominees is 60.2 if adjusted for the two additional nominees from the KLA-Tencor board in proposal number two. |

| (4) | The average tenure of the director nominees is 4.87 if adjusted for the two additional nominees from the KLA-Tencor board in proposal number two. |

| (5) | The number of independent nominated directors is nine if adjusted for the two additional nominees from the KLA-Tencor board in proposal number two. |

| (6) | The number of nominated directors on more than four public company boards is still zero if adjusted for the two additional nominees from the KLA-Tencor board in proposal number two. |

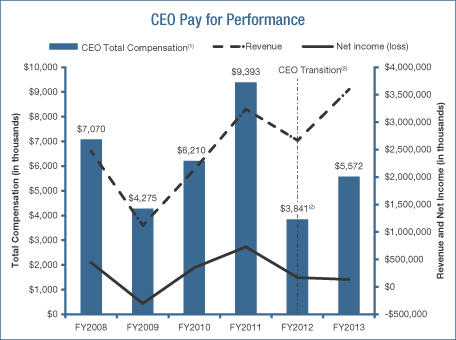

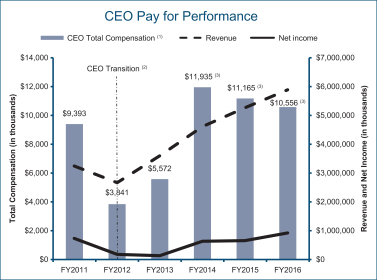

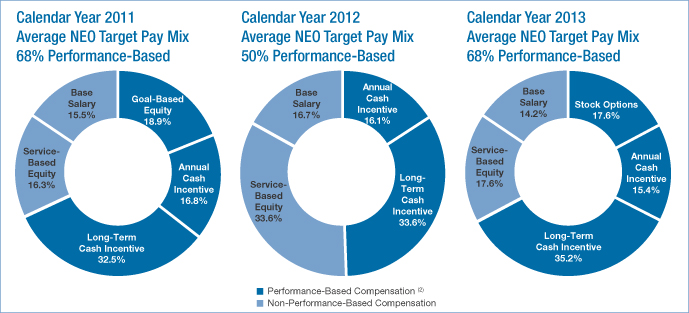

Figure 4. Executive Compensation Highlights

| What We Do |

| Pay for Performance (Pages 14-16, 20-22, 23-25) – Our executive compensation program is designed to pay for performance with 100% of the short-term incentive program tied to company financial, strategic and operational performance metrics, 50% of the long-term incentive program tied to total shareholder return, or “TSR,” performance, and 50% of the long-term incentive program awarded in stock options and service-based restricted stock units, or “RSUs.” |

| Three-Year Performance Period for Our 2016 Long-Term Incentive Program (Pages 23-25) – Our current long-term incentive program is designed to pay for performance over a period of three years. |

| Absolute and Relative Performance Metrics (Pages 20-22, 23-25) – Our annual and long-term incentive programs for executive officers include the use of absolute and relative performance factors. |

| Balance of Annual and Long-Term Incentives– Our incentive programs provide a balance of annual and longer-term incentives. |

| Different Performance Metrics for Annual and Long-Term Incentive Programs(Pages 20-22, 23-25) – Our annual and long-term incentive programs use different performance metrics. |

| Capped Amounts(Pages 20, 24-25) – Amounts that can be earned under the annual and long-term incentive programs are capped. |

| Compensation Recovery/Clawback Policy (Page 17) – We have a policy in which we can recover the excess amount of cash incentive-based compensation granted and paid to our officers who are covered by section 16 of the Exchange Act. |

| Prohibit Option Repricing– Our stock incentive plans prohibit option repricing without stockholder approval (excluding adjustments due to specified corporate transactions and changes in capitalization). |

| Hedging and Pledging Policy(Page 7) – We have a policy applicable to our executive officers and directors that prohibits pledging and hedging. |

| Stock Ownership Guidelines (Page 17) – We have stock ownership guidelines for each of our executive officers and certain other senior executives; each of our NEOs has met his or her individual ownership level under the current program or has a period of time remaining under the guidelines to do so. |

| Independent Compensation Advisor (Page 18) – The compensation committee benefits from its utilization of an independent compensation advisor retained directly by the committee that provides no other services to the Company. |

| Stockholder Engagement– We engage with stockholders and stockholder advisory firms to obtain feedback concerning our compensation program. |

| What We Don’t Do |

| Tax “Gross-Ups” for Perquisites, for Other Benefits or upon a Change in Control(Pages 27-30, 35-36) – Our executive officers do not receive tax “gross-ups” for perquisites, for other benefits or upon a change in control.(1) |

| Single-Trigger Change in Control Provisions (Pages 26, 35-36) – None of our executive officers has single-trigger change in control agreements. |

| (1) | Our executive officers may receive tax gross-ups in connection with relocation benefits that are widely available to all of our employees. |

Continues on next page u

| Lam Research Corporation 2016 Proxy Statement | 3 |

our bylaws—which would be publicly disclosed by the Company—and to any provisions of then-applicable SEC rules), the principal requirements for the 2014 annual meeting would be as follows:

For proposals and for nominations:

Additionally, for nominations, the notice must:

Additionally, forproposals, the notice must set forth a brief description of such business, the reasons for conducting such business at the meeting and any material interest in such business of such Stockholder and the Beneficial Owner, if any, on whose behalf the proposal is made.

For a full description of the requirements for submitting a proposal or nomination, see the Company’s bylaws. Submissions or questions should be sent to: Secretary, Lam Research Corporation, 4650 Cushing Parkway, Fremont, California 94538.

|

A board of eleven directors is to be elected at the 2013 annual meeting. In general, the eleven nominees who receive the highest number of “for” votes will be elected. However, any nominee who fails to receive affirmative approval from holders of a majority of the votes cast in such nominee’s election at the annual meeting, either by proxy or in person, will not be elected to the board, even if he or she is among the top eleven nominees in total “for” votes. This requirement reflects the majority vote provisions implemented by the Company in November 2009. The term of office of each person elected as a director will be for the ensuing year, and until his or her successor is elected and qualified.

Unless otherwise instructed, the Proxy Holders will vote the proxies received by them for the eleven nominees named below, each of whom is currently a director of the Company. The proxies cannot be voted for more than eleven nominees, whether or not there are additional nominees. If any nominee of the Company should decline or be unable to serve as a director as of the time of the annual meeting, and unless otherwise instructed, the proxies will be voted for any substitute nominee designated by the present board of directors to fill the vacancy. The Company is not aware of any nominee who will be unable, or will decline, to serve as a director.

The below nominees for reelection have been nominated for election to the board of directors in accordance with the criteria and procedures discussed below in “Corporate Governance.”

In addition to the below biographical information concerning each board nominee’s specific experience, attributes, positions and qualifications and age as of September 1, 2013, we believe that each of our nominees, while serving as a director and/or officer of the Company, has devoted adequate time to the board of directors and performed his or her duties with critical attributes such as honesty, integrity, wisdom, and an adherence to high ethical standards. Each nominee has demonstrated strong business acumen, an ability to make independent analytical inquiries, an ability to understand the Company’s business environment, and an ability to exercise sound judgment, as well as a commitment to the Company and its core values. We believe the nominees have an appropriate diversity and interplay of viewpoints, skills and experiences that will encourage a robust decision-making process for the board.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” EACH OF THE DIRECTOR NOMINEES SET FORTH BELOW.

|

|

| |

|

| |

|

| |

|

|

| |

|

| |

|

| |

|

|

| |

|

| |

|

| |

|

|

|

|

|

Security Ownership of Certain Beneficial Owners and Management

The table below sets forth the beneficial ownership of shares of Lam common stock by: (i) each person or entity who we believe based on our review of filings made with the SECUnited States Securities and Exchange Commission, or the “SEC,” beneficially owned as of September 9, 2013,13, 2016, more than 5% of Lam’s common stock on the date set forth below; (ii) each current director of the Company; (iii) each named executive officerdirector nominee identified in proposal number two, (iv) each NEO identified below in the “Compensation Matters – Executive Compensation and Other Information – Compensation Discussion and Analysis” section; and (iv)(v) all current directors, additional nominees identified in proposal number two and

current executive officers as a group. With the exception of 5% owners, and unless

otherwise noted, the information below reflects holdings as of September 9, 2013,13, 2016, which is the Record Date for the 20132016 annual meeting and the most recent practicable date for determining ownership. For 5% owners, holdings are as of the dates of their most recent ownership reports filed with the SEC, which are the most practicable dates for determining their holdings. The percentage of the class owned is calculated using 162,092,907161,264,422 as the number of shares of Lam common stock outstanding on September 9, 2013.13, 2016.

Figure 5. Beneficial Ownership Table

|

| Name of Person or Identity of Group | Shares Beneficially Owned (#)(1) | Percentage of Class | ||||||

5% Stockholders | ||||||||

JPMorgan Chase & Co.

| (2) | % | ||||||

The Vanguard Group, Inc.

| (3) | |||||||

| % | ||||||||

BlackRock Inc. | 10,331,709 | (4) | 6.4 | % | ||||

Ameriprise Financial, Inc. | 8,023,367 | (5) | 5.0 | % | ||||

| Directors | ||||||||

Martin B. Anstice (also a Named Executive Officer) | * | |||||||

Eric K. Brandt | * | |||||||

Michael R. Cannon | * | |||||||

Youssef A. El-Mansy | * | |||||||

Christine A. Heckart | * | |||||||

| ||||||||

Catherine P. Lego | * | |||||||

Stephen G. Newberry | * | |||||||

Krishna C. Saraswat | * | |||||||

| ||||||||

Abhijit Y. Talwalkar | * | |||||||

Lih Shyng (Rick L.) Tsai | — | * | ||||||

| Additional Director Nominees | ||||||||

John T. Dickson | — | * | ||||||

Gary B. Moore | — | * | ||||||

| Named Executive Officers (“NEOs”) | ||||||||

Timothy M. Archer | * | |||||||

Douglas R. Bettinger | * | |||||||

Richard A. Gottscho | * | |||||||

Sarah A. O’Dowd | * | |||||||

| ||||||||

All current directors, additional director nominees and executive officers as a group | (6) | * | ||||||

| * | Less than 1% |

| Includes shares subject to outstanding stock options that are now exercisable or will become exercisable within 60 days after September |

| Shares | ||||

Martin B. Anstice | ||||

Eric K. Brandt | ||||

Michael R. Cannon | ||||

| ||||

| ||||

| ||||

Catherine P. Lego | ||||

| ||||

| ||||

| ||||

Abhijit Y. Talwalkar | ||||

| ||||

| ||||

| ||||

| ||||

| ||||

All current directors, additional director nominees and executive officers as a group | ||||

The terms of any outstanding stock options that are now exercisable are reflected in “Figure 31. FYE2016 Outstanding Equity Awards” below.

As discussed in “Governance Matters – Director Compensation” below, the non-employee directors receive an annual equity grant as part of their compensation. These grants generally vest on October 31, 2016, subject to continued service on the board as of that date, with immediate delivery of the shares upon vesting. For 2015, Drs. El-Mansy and Saraswat; Messrs. Brandt, Cannon, Newberry and Talwalkar; and Mses. Heckart and Lego each received grants of 2,600 RSUs. These RSUs are included in the tables above. As of September 13, 2016, Dr. Tsai had not yet been granted an annual equity award and Messrs. Dickson and Moore had not yet been appointed to the board of the Company. In accordance with the Company’s non-employee director compensation program, Dr. Tsai will receive a pro-rated equity award (25% of the $200,000 targeted grant date value, with the number of RSUs determined in the same manner as an annual equity award) on the first Friday following his first attended board meeting (or, if the designated date falls within a blackout window under applicable Company policies, on the first following business day such grant is permissible under those policies).

| (2) | All information regarding JPMorgan Chase & Co., or “JPMorgan Chase,” is based solely on information disclosed in amendment number |

| All information regarding The Vanguard Group, Inc., or “Vanguard,” is based solely on information disclosed in |

| (4) | All information regarding BlackRock Inc., or “BlackRock,” is based solely on information disclosed in amendment number eight to Schedule 13G filed by BlackRock with the SEC on February 10, 2016 on behalf of BlackRock and its subsidiaries: BlackRock (Channel Islands) Ltd; BlackRock (Luxembourg) S.A.; BlackRock (Netherlands) B.V.; BlackRock (Singapore) Limited; BlackRock Advisors (UK) Limited; BlackRock Advisors, LLC; BlackRock Asset Management Canada Limited; BlackRock Asset Management Deutschland AG; BlackRock Asset Management Ireland Limited; BlackRock Asset Management North Asia Limited; BlackRock Asset Management Schweiz AG; BlackRock Capital Management; BlackRock Financial Management, Inc.; BlackRock Fund Advisors; BlackRock Fund Managers Ltd; BlackRock Institutional Trust Company, N.A.; BlackRock International Limited; BlackRock Investment Management (Australia) Limited; BlackRock Investment Management (UK) Ltd; BlackRock Investment Management, LLC; BlackRock Japan Co Ltd; and BlackRock Life Limited. According to the Schedule 13G filing, of the 10,331,709 shares of Lam common stock reported as beneficially owned by BlackRock as of December 31, 2015, BlackRock had sole voting power with |

Continues on next page u

| Lam Research Corporation 2016 Proxy Statement | 5 |

| respect to 8,837,695 shares, did not have shared voting power with respect to any other shares, had sole dispositive power with respect to |

| (5) | All information regarding Ameriprise Financial, Inc., or “Ameriprise,” is based solely on information disclosed in amendment number three to Schedule 13G filed by Ameriprise with the SEC on February 12, 2016. According to the Schedule 13G filing, of the |

| Includes |

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires our executive officers, directors, and people who own more than 10% of a registered class of our equity securities to file an initial report of ownership (on a Form 3) and reports on subsequent changes in ownership (on Forms 4 or 5) with the SEC by specified due dates. Our executive officers, directors, and greater-than-10% stockholders are also required by SEC rules

to furnish us with copies of all section 16(a) forms they file. We are required to disclose in this proxy statement any failure to file any of these reports on a timely basis. Based solely on our review of the copies of the forms that we received from the filers, and on written representations from certain reporting persons, we believe that all of these requirements were satisfied during fiscal year 2016.

Our board of directors and members of management are committed to responsible corporate governance to manage the Company for the long-term benefit of its stockholders. To that end, the board and management periodically review and update, as appropriate, the Company’s corporate governance policies and practices. As part of that process, the board and management reviewconsider the requirements of federal and state law, including rules and regulations of the SEC; the listing standards for the NASDAQNasdaq Global Select Market, or “NASDAQ;“Nasdaq;” published guidelines and recommendations of proxy advisory firms; and published guidelines of other selected public companies.companies; and any feedback we receive from our stockholders. A list of key corporate governance practices is provided in the “Proxy Statement Summary” above.

We have instituted a variety of policies and procedures to foster and maintain responsible corporate governance, including the following:

Board committee charters. Each of the board’s audit, compensation and nominating and governance committees has a written charter adopted by the board that establishes practices and procedures for the committee in accordance with applicable corporate governance rules and regulations. Each committee reviews its charter annually and recommends changes to the board, as appropriate. Each committee charter is available on the investors’ page of our web site athttp://investor.lamresearch.cominvestor.lamresearch.com/corporate-governance.cfm. Please alsoThe content on any website referred to in this proxy statement is not a part of or incorporated by reference in this proxy statement unless expressly noted. Also refer to “Board Committees” below, for a description of responsibilities ofadditional information regarding these board committees.

Corporate governance guidelines. We adhere to written corporate governance guidelines, adopted by the board and reviewed annually by the nominating and governance committee and the board. Selected provisions of the guidelines are discussed below, including in the “Board Nomination Policies and Procedures,” “Director Independence Policies” and “Other Governance Practices” sections below. The corporate governance guidelines are available on the investors’ page of our web site athttp://investor.lamresearch.cominvestor.lamresearch.com/corporate-governance.cfm.

Corporate code of ethics. We maintain a code of ethics that applies to all employees, officers, and members of the board. The code of ethics establishes standards reasonably

necessary to promote honest and ethical conduct, including the ethical handling of actual or apparent conflicts of interest between personal and professional relationships, and full, fair, accurate, timely, and understandable disclosure in the periodic reports we file with the SEC and in other public communications. We will promptly disclose to the public any amendments to,

or waivers from, any provision of the code of ethics to the extent required by applicable laws. We intend to make this public disclosure by posting the relevant material on our web site,website, to the extent permitted by applicable laws. A copy of the code of ethics is available on the investors’ page of our web sitewebsite athttp://investor.lamresearch.cominvestor.lamresearch.com/corporate-governance.cfm.

Global standards of business conduct policy. We maintain written standards of appropriate conduct in a variety of business situations that apply to employees worldwide.our worldwide workforce. Among other things, these global standards of business conduct prohibit employees from engaging in “short sales”address relationships with one another, relationships with Lam (including conflicts of Lam securities or from purchasing or selling “put” or “call” options for Lam securities (other than stock options issued under our employee equity plans). These measures help to ensure that our employees will not benefit from a decline in Lam’s stock price,interest, safeguarding of Company assets and will remain focused on our business success.protection of confidential information) and relationships with other companies and stakeholders (including anti-corruption).

Insider trading policy. Our insider trading policy restricts the trading of Company stock by our directors, officers, and employees, and includes provisions addressing insider blackout periods margin accounts and hedging transactions.prohibiting hedges and pledges of Company stock.

Board Nomination Policies and Procedures

Board membership criteria. Under our corporate governance guidelines, the nominating and governance committee is responsible for assessing the appropriate balance of experience, skills and characteristics required for the board and for recommending director nominees to the independent directors.

The guidelines direct the committee to consider all factors it considers appropriate. The committee need not consider all of the same factors for every candidate. Factors to be considered may include, but are not limited to: experience; business acumen; wisdom; integrity; judgment; the ability to make independent analytical inquiries; the ability to understand the Company’s business environment; the candidate’s willingness and ability to devote adequate time to board duties; specific skills, background or experience considered necessary or desirable for board or committee service; specific experiences with other businesses or

Continues on next page u

| Lam Research Corporation 2016 Proxy Statement | 7 |

organizations that may be relevant to the Company or its industry; diversity with respect to any attribute(s) the board considers desirable;appropriate, including geographic, gender, age and ethnic diversity; and the interplay of a candidate’s experiences and skills with the experiences and skillsthose of other board members.

The board and the nominating and governance committee regard board refreshment as important, and strive to maintain an appropriate balance of tenure, turnover, diversity and skills on the board. The board believes that new perspectives and ideas are important to a forward-looking and strategic board as is the ability to benefit from the valuable experience and familiarity of longer-serving directors.

|

Prior to recommending that an incumbent non-employee director be nominated for reelection to the board, the committee reviews the experiences, skills and qualifications of the directors to assess the continuing relevance of the directors’ experiences, skills and qualifications to those considered necessary or desirable for the board at that time.

Board members may not serve on more than four boards of public companies (including service on the Company’s board).

To be nominated, a new or incumbent candidate must provide an irrevocable conditional resignation that will be effective upon (i) the director’s failure to receive the required majority vote at an annual meeting at which the nominee faces re-election and (ii) the board’s acceptance of such resignation. In addition, no director, after having attained the age of 75 years, may be nominated for re-election or reappointment to the board.

Nomination procedure. The nominating and governance committee identifies, screens, evaluates and recommends qualified candidates for appointment or election to the board.board based on the board’s needs and desires at that time as developed through their self-evaluation process. The committee considers recommendations from a variety of sources, including search firms, board members, executive officers and stockholders. Formal nominationsNominations for election by the stockholders are made by the independent members of the board. See “Voting Proposals – Proposal No. 1: Election of Existing Directors – 2016 Nominees for Director” and “Voting Proposals – Proposal No. 2: Election of Additional Directors – 2016 Nominees for Director” below for additional information regarding the 2016 candidates for election to the board.

Certain provisions of our bylaws apply to the nomination or recommendation of candidates by a stockholder. Information regarding the nomination procedure is provided in the “Voting and Meeting Information – Other Meeting Information – Stockholder-Initiated Proposals and Nominations for 20142017 Annual Meeting” section above.below.

Director Independence Policies

Board independence requirements. Our corporate governance guidelines require that at least a majority of the board members be independent in accordance with NASDAQ rules.independent. No director will qualify as “independent” unless the board affirmatively determines that the director qualifies as independent under the Nasdaq rules and has no relationship that would interfere with the exercise of independent judgment as a director. In addition, no non-employee director may serve as a consultant or service provider to the Company without the approval of a majority of the independent directors (and any such director’s independence must be reassessed by the full board following such approval).

Board member independence. The board has determined that all current directors, other than Messrs. Anstice and Newberry, are independent in accordance with NASDAQNasdaq criteria for director independence.

Board committee independence.All members of the board’s audit, compensation, and nominating and governance committees must be non-employee or outside directors and independent in accordance with applicable NASDAQNasdaq criteria as well as, in the case of the compensation committee, applicable rules under section 162(m) of the Internal Revenue Code of 1986, as amended, or the “Code,” and Rule 16b-3 of

the Securities Exchange Act of 1934, as non-employee directors.amended, or the “Exchange Act.” See “Board Committees” below for a description of the responsibilities ofadditional information regarding these board committees.

Lead independent director. Our corporate governance guidelines authorize the board to designate a lead independent director from among the independent board members. The lead independent director is responsible for coordinating the activities of the independent directors, consulting with the chairman regarding matters such as schedules of and agendas for board meetings and the retention of consultants who report directly to the board, and developing the agenda for and moderating executive sessions of the board’s independent directors. Mr. Inman has served asTalwalkar was appointed the lead independent director, since his reelection ateffective August 27, 2015, succeeding Grant Inman, who retired in 2015. See “Leadership Structure of the 2012 annual meeting.Board” below for information regarding the responsibilities of the lead independent director.

Executive sessions of independent directors. The board and its audit, compensation, and nominating and governance committees hold meetings of the independent directors and committee members, without management present, as part of each regularly scheduled meeting and at any other time at the discretion of the board or committee, as applicable.

Board access to independent advisors. The board as a whole, and each of the board standing committees separately, mayhas the complete authority to retain, at the Company’s expense, and may terminate, in their discretion, any independent consultants, counselors, or advisors as they deem necessary or appropriate to fulfill their responsibilities.

Board education program. Our corporate governance guidelines provide that directors are expected to participate in educational events sufficient to maintain their understanding of their duties as directors and to enhance their ability to fulfill their responsibilities. In addition to any external educational opportunities that the directors find useful, the Company and the board leadership are expected to facilitate such participation by arranging for appropriate educational content to be incorporated into regular board and committee meetings as well as on a quarterly basis presented by board and/or committee advisors and counsel independent of any content at regular board and committee meetings.

Leadership Structure of the Board

The current leadership structure of the board consists of a chairman and a lead independent director. The chairman, Mr. Newberry, served as chief executive officer of the Company or “CEO,” from June 2005 to January 2012. The board believes that this is the appropriate board leadership structure at this time. Lam and its stockholders benefit from having Mr. Newberry as its chairman, as he brings to bear his experience as CEO as well as his other qualifications in carrying out his responsibilities as chairman.chairman, which include (i) preparing the agenda for the board meetings with input from the CEO, the board and the committee chairs; (ii) upon invitation, attending meetings of any of the board committees on which he is not a member; (iii) conveying to the CEO, together with the chair of the compensation committee, the results of the CEO’s performance evaluation; (iv) reviewing proposals submitted by stockholders for action at meetings of stockholders and, depending on the subject matter, determining the appropriate body, among the board or any of the board committees, to evaluate each proposal and making recommendations to the board regarding action to be taken in response to such proposal; (v) performing such duties as the board may reasonably assign at the request of the CEO; (vi) performing such other duties as the board may reasonably request from time to time; and (vii) providing reports to the board on the chairman’s activities under his agreement. The Company and its stockholders also benefit from having a lead independent director to provide independent board leadership. The lead independent director is responsible for coordinating the activities of the independent directors; consulting with the chairman regarding matters such as schedules of and agendas for board meetings; the quality, quantity and timeliness of the flow of information from management; the retention of consultants who report directly to the board; and developing the agenda for and moderating executive sessions of the board’s independent directors.

In addition to the principal policies and procedures described above, we have established a variety of other practices to enhance our corporate governance, including the following:

Board and committee assessments.At least bi-annually,once every two years, the board conducts a self-evaluation of the board, its committees, and the individual directors, overseen by the

nominating and governance committee. To the extent the board requests, the committee also oversees evaluations of the board’s standing committees.

Director resignation or notification of change in executive officer status. Under our corporate governance guidelines, any director who is also an executive officer of the Company must offer to submit his or her resignation as a director to the board if the director ceases to be an executive officer of the Company. The board may accept or decline the offer, in its discretion. The corporate governance guidelines also require a non-employee director to notify the nominating and governance committee if the director changes or retires from his or her executive position at another company. The nominating and governance committee reviews the appropriateness of the director’s continuing board membership under the circumstances, and the director is expected to act in accordance with the nominating and governance committee’s recommendations.

Director and executive stock ownership. Under the corporate governance guidelines, each director is expected to own at least the lesser of five times the value of the annual cash retainer (not including any committee chair or other supplemental retainers for directors) or 5,000 shares of Lam common stock, whichever is less, by the fifth anniversary of his or her initial election to the board. Guidelines for stock ownership by designated members of the executive management team are described below under “Compensation Matters – Executive Compensation and OtherInformation – Compensation Discussion and Analysis.” All of our directors and designated members of our executive management team were in compliance with the Company’s applicable stock ownership guidelines at the end of fiscal year 2013.2016 or have a period of time remaining under the program to do so.

Communications with board members. Any stockholder who wishes to communicate directly with the board of directors, with any board committee or with any individual director regarding the Company may write to the board, the committee or the director c/o Secretary, Lam Research Corporation, 4650 Cushing Parkway, Fremont, California 94538. The Secretarysecretary will forward all such communications to the appropriate director(s).

Any stockholder, employee, or other person may communicate any complaint regarding any accounting, internal accounting control, or audit matter to the attention of the board’s audit committee by sending written correspondence by mail (to Lam Research Corporation, Attention: Board Audit Committee, P.O. Box 5010, Fremont, California 94537-5010) or by thephone (855-208-8578) or internet (through the Company’s third party provider web site athttps://secure.ethicspoint.com/domain/ media/en/gui/35911/index.htmlwww.lamhelpline.ethicspoint.com)). The audit committee has established procedures to ensure that employee complaints or

Continues on next page u

| Lam Research Corporation 2015 Proxy Statement | 9 |

concerns regarding audit or accounting

matters will be received and treated anonymously (if the complaint or concern is submitted anonymously)anonymously and confidentially.permitted under applicable law).

All of the directors attended at least 75% of the aggregate number of board meetings and meetings of board committees on which they served during their board tenure in fiscal year 2013.2016. Our board of directors held a total of four13 meetings during fiscal year 2013.2016.

We expect our directors to attend the annual meeting of stockholders each year and to respond to appropriate questions.year. All individuals who were directors as of the 20122015 annual meeting of stockholders attended the 20122015 annual meeting of stockholders.

The board of directors has three standing committees: an audit committee, a compensation committee, and a nominating and governance committee. The purpose, membership and charter of each are described below.

Figure 6. Committee Membership

| ||||||||||||

| ||||||||||||

| ||||||||||||

| ||||||||||||

| ||||||||||||

| ||||||||||||

| ||||||||||||

| ||||||||||||

| ||||||||||||

| ||||||||||||

| Current Committee Memberships | ||||||

| Name | Audit | Compensation | Nominating and Governance | |||

| Eric K. Brandt | Chair | |||||

| Michael R. Cannon | x | x | ||||

| Youssef A. El-Mansy | x | |||||

| Christine A. Heckart | x (1) | |||||

| Catherine P. Lego | Chair (2) | x | ||||

| Abhijit Y. Talwalkar | x (3) | Chair (4) | ||||

| Total Number of Meetings Held in FY2016 | 8 | 5 | 6 | |||

| (1) |

| (2) | Ms. Lego was appointed as chair of the compensation committee effective August 27, 2015. Until that time, she served as a member of the audit committee. |

| (3) | Mr. |

| (4) | Mr. Talwalkar was appointed as a member of the nominating and governance committee effective May 14, 2015 and as chair of the |

Audit committee. The purpose of the audit committee is to oversee the Company’s accounting and financial reporting processes and the audits of our financial statements, including the system of internal controls. TheAs part of its responsibilities, the audit committee is not responsible for planning or conducting our audits, or determining whether our financial statements are completereviews and accurate or prepared in accordance with generally accepted accounting principles.oversees the potential conflict of interest situations, transactions required to be

disclosed pursuant to Item 404 of Regulation S-K of the SEC and any other transaction involving an executive or board member. A copy of the audit committee charter is available on the investors’ page of our web site athttp://investor.lamresearch.com/corporate-governance.cfm.

|

The board concluded that all audit committee members are non-employee directors who are independent in accordance with the NASDAQNasdaq listing standards and SEC rules for audit committee member independence and that each audit committee member is able to read and understand fundamental financial statements as required by the NASDAQNasdaq listing standards. The board also determined that Ms. Lego,Mr. Brandt, the chair of the committee, during fiscal year 2013, and Mr. Brandt, a member of theis an “audit committee during fiscal year 2013, are each a “financialfinancial expert” as defined in the SEC rules. The audit committee held nine meetings during fiscal year 2013.

The audit committee’s responsibilities include (but are not limited to) the following:

Compensation committee. The purpose of the compensation committee is to discharge certain responsibilities of the board relating to executive

compensation, compensation; to oversee incentive, equity-based plans and other compensatory plans in which the Company’s executive officers and/or directors participateparticipate; and to produce an annual report on executive compensation for inclusion as required in the Company’s annual proxy statement. The compensation committee is authorized to perform the responsibilities of the committee referenced above and described in the charter. A copy of the compensation committee charter is available on the investors’ page of our web site athttp://investor.lamresearch.com/corporate-governance.cfm.

The board concluded that all members of the compensation committee are non-employee directors who are independent in accordance with Rule 16b-3 of the Exchange Act and the NASDAQNasdaq criteria for director and compensation committee member independence and who are outside directors for purposes of section 162(m) of the Code. The compensation committee held seven meetings during fiscal year 2013.

The compensation committee’s responsibilities include (but are not limited to) the following:

Nominating and governance committee. The purpose of the nominating and governance committee is to identify individuals qualified to serve as members of the board of the Company, to recommend nominees for election as directors of the Company, to oversee self-evaluations

of the board’s performance, to develop and recommend corporate governance guidelines to the board, and to provide oversight with respect to corporate governance. A copy of the nominating and governance and ethical conduct.committee charter is available on the investors’ page of our web site athttp://investor.lamresearch.com/corporate-governance.cfm.

The board concluded that all nominating and governance committee members are non-employee directors who are independent in accordance with the NASDAQNasdaq criteria for director independence. The nominating and governance committee held four meetings during fiscal year 2013.

The nominating and governance committee’s responsibilities include (but are not limited to) the following:

The nominating and governance committee recommended the slate of nominees for director set forth in Proposal No.1. The independent members of the board approved the recommendations and nominated the proposed slate of nominees.

The nominating and governance committee will consider for nomination persons properly nominated by stockholders in accordance with the Company’s bylaws and other procedures described in thebelow under “Stockholder—InitiatedVoting and Meeting Information –

Other Meeting Information – Stockholder-Initiated Proposals and Nominations for 20142017 Annual MeetingMeeting.” section above. Subject to then-applicable law, stockholder nominations for director will be evaluated by the Company’s nominating and governance committee in accordance with the same criteria as is applied to candidates identified by the nominating and governance committee or other sources.

Board’s Role in Risk Oversight

The board is actively engaged in risk oversight. Management regularly reports to the board on its risk assessments and risk mitigation strategies for the major risks of directors hasour business. Generally, the board exercises its oversight responsibility directly; however, in specific cases, such responsibility has been delegated to board committees. Committees that have

been charged with respectrisk oversight regularly report to the board on those risk matters within their areas of responsibility. Risk oversight responsibility has been delegated to board committees as follows:

The board provides risk oversight by: (1) overseeing our risk management processes; (2) overseeing our strategic goals and objectives in the context of our material risk exposures; and (3) receiving reports from management on various types of risks and management’s processes for managing such risks.

The board has delegated oversight responsibility for certain areas of risk exposurerelated to its standing committees.

Assessment of Compensation Risk

Management conducted a compensation risk assessment in 2013 and concluded that the Company’s currentequity, and executive compensation programs are not reasonably likelyand plans.

|

TheOur director compensation is designed to attract and retain high caliber directors and to align director interests with those of our non-employee directorsstockholders. Director compensation is reviewed and determined annually by the board (in the case of Messrs. Newberry and Anstice, by the independent members of the board), upon recommendation from the compensation committee. Non-employee director compensation (including the compensation of Mr. Newberry, who is currently our non-employee chairman) is described below. Mr. Anstice, whose compensation as CEO is described below under “Compensation Matters – Executive Compensation and Other Information – Compensation Discussion and Analysis,” does not receive additional compensation for his service on the board.

Non-employee director compensation. Non-employee directors receive annual cash retainers and equity awards. The chairman of the board, committee chairs, the lead independent director and committee members receive additional cash retainers. TheNon-employee directors who join the board endeavors to maintain formsor a committee midyear receive pro-rated cash retainers and amounts ofequity awards, as applicable. Our non-employee director compensation that will attract and retain directors ofprogram is based on service during the caliber desired by the Company and that align director interests with those of stockholders. Other than Mr. Newberry, board members who are also employees do not receive any additional compensation for service on the board.

Our director compensation plans run on a calendar-year basis. However,calendar year; however, SEC rules require us to report compensation in this proxy statement on a fiscal-year basis. The types and rates of cash compensation are included in the table below. Cash compensation paid to non-employee directors for the fiscal year ended June 30, 201326, 2016 is shown in the table below, together with the annual cash compensation program components in effect for calendarscalendar years 20122015 and 2013. For directors who joined the board or a committee during the fiscal year, the fiscal year 2013 compensation is prorated.2016.

Figure 7. Director Annual Retainers

Calendar ($) | Calendar ($) | Fiscal ($) | ||||||||||

Annual Retainer | 60,000 | 60,000 | 60,000 | |||||||||

Lead Independent Director | 20,000 | 15,000 | 17,500 | |||||||||

Audit Committee – Chair | 25,000 | 25,000 | 25,000 | |||||||||

Audit Committee – Member | 12,500 | 12,500 | 12,500 | |||||||||

Compensation Committee – Chair | 20,000 | 20,000 | 20,000 | |||||||||

Compensation Committee – Member | 10,000 | 10,000 | 10,000 | |||||||||

Nominating and Governance Committee – Chair | 10,000 | 10,000 | 10,000 | |||||||||

Nominating and Governance Committee – Member | 5,000 | 5,000 | 5,000 | |||||||||

Non-employee directors also receive equity awards for their board service. New non-employee directors are generally eligible to receive an initial equity grant in the form of RSUs, upon the date of the first regularly scheduled board meeting attended by that director after first being appointed or elected to the board, with a targeted grant date value equal to $250,000 (the number of RSUs subject to the award is determined by dividing $250,000 by the fair market value of a share of Lam common stock as of the date of grant, rounded down to the nearest 10 shares). The initial RSUs vest in four equal annual installments from the date of grant subject to the director’s continued service on the board. These equity grants are subject to the terms and conditions of the Company’s 2007 Stock Incentive Plan, as amended, and the applicable award agreements.

| Annual Retainers | Calendar Year 2016 ($) | Calendar Year 2015 ($) | Fiscal Year 2016 ($) | |||||||||

| Non-employee Director | 65,000 | 60,000 | 62,500 | |||||||||

| Lead Independent Director | 22,500 | 20,000 | 21,250 | |||||||||

| Chairman | 280,000 | 280,000 | 280,000 | |||||||||

| Audit Committee – Chair | 30,000 | 25,000 | 27,500 | |||||||||

| Audit Committee – Member | 12,500 | 12,500 | 12,500 | |||||||||

| Compensation Committee – Chair | 20,000 | 20,000 | 20,000 | |||||||||

| Compensation Committee – Member | 10,000 | 10,000 | 10,000 | |||||||||

| Nominating and Governance Committee – Chair | 15,000 | 10,000 | 12,500 | |||||||||

| Nominating and Governance Committee – Member | 5,000 | 5,000 | 5,000 | |||||||||

Each non-employee director is eligible to receivealso receives an annual equity grant on a designated date in January of each yearthe first Friday following the annual meeting (or, if the designated date falls within a

blackout window under applicable Company policies, on the first following business day such grant is permissible under those policies) with a targeted grant date value equal to $160,000$200,000 (the number of RSUs subject to the award is determined by dividing $160,000$200,000 by the fair market valueclosing price of a share of Company common stock as of the date of grant, rounded down to the nearest 10 shares). These grants generally vest on November 1October 31 in the

Continues on next page u

| Lam Research Corporation 2015 Proxy Statement | 11 |

year offollowing the grant and are subject to the terms and conditions of the Company’s 20072015 Stock Incentive Plan, as amended, or the “2015 Plan,” and the applicable award agreements.

Each These grants immediately vest in full: (i) if a non-employee director dies or becomes subject to a “disability” (as determined pursuant to the 2015 Plan), (ii) upon the occurrence of a “Corporate Transaction” (as defined in the 2015 Plan), or (iii) on the date of the annual meeting if the annual meeting during the year in which the award was expected to vest occurs prior to the vest date and the non-employee director is not re-elected or retires or resigns effective immediately prior to the annual meeting. Non-employee directors who commence service after the annual award has been granted receive a pro-rated grant based on the number of regular board meetings remaining in the year as of the date of the director’s election.

On November 6, 2015, each director other than Mr. Anstice, and Dr. Tsai who was on the board on January 28, 2013not a director during fiscal year 2016, received a grant of 3,8302,600 RSUs for services during calendar year 2013. Each RSU grant issued on January 28, 2013 vests2016. Unless there is an acceleration event, these RSUs will vest in full on November 1, 2013, generallyOctober 31, 2016, subject to the director’s continued service on the board. Receipt

Chairman compensation. Mr. Newberry, who served as vice-chairman from December 7, 2010 until November 1, 2012 and since such date has served as chairman, has a chairman’s agreement documenting his responsibilities, described above under “Governance Matters – Corporate Governance – Leadership Structure of the sharesBoard,” and compensation. Mr. Newberry entered into a chairman’s agreement with the Company commencing on January 1, 2016 and expiring on December 31, 2016, subject to the right of earlier termination in certain circumstances and a one year extension upon mutual written agreement of the parties. The agreement provides that Mr. Newberry will serve as chairman (and not as an employee or officer) and in addition to his regular compensation as a non-employee director, he receives an additional cash retainer of $280,000 on the same date.

Mr. Newberry was eligible to participate through 2014 in the Company’s Elective Deferred Compensation Plan that is deferredgenerally applicable to executives of the Company, subject to the general terms and conditions of such plan. He continues to maintain a balance in the plan until January 31, 2014.he no longer performs service for the Company as a director but is no longer eligible to defer any compensation into the plan.

The following table shows compensation for fiscal year 20132016 for persons serving as directors during fiscal 2016 other than Mr. Anstice, whose compensation is described below under “Anstice:

Figure 8. FY2016 Director Compensation Discussion and Analysis”:

| Director Compensation for Fiscal Year 2016 | Director Compensation for Fiscal Year 2016 | |||||||||||||||||||||||||||||||||||

| Fees Earned or Paid in Cash ($) | Stock Awards ($) (1)(2) | All Other sation | Total ($) | |||||||||||||||||||||||||||||||||

Director Compensation for Fiscal Year 2013

| ||||||||||||||||||||||||||||||||||||

| Name | Fees Earned or Paid in Cash ($) | Stock Awards ($)(1) | Non-Equity Incentive Plan Compensation ($) | All Other Compensation ($)(2) | Total ($) | |||||||||||||||||||||||||||||||

Stephen G. Newberry | 541,692 | (3) | 79,723 | (17) | 343,962 | (19) | 5,330 | 970,707 | 345,000 | (4) | 196,846 | 23,962 | 565,808 | |||||||||||||||||||||||

James W. Bagley | 263,365 | (4) | 0 | 0 | 14,875 | 278,241 | ||||||||||||||||||||||||||||||

Robert M. Berdahl | 42,500 | (5) | 0 | 0 | 17,974 | 60,474 | ||||||||||||||||||||||||||||||

Eric K. Brandt | 72,500 | (6) | 159,864 | (18) | 0 | 0 | 232,364 | 95,000 | (5) | 196,846 | — | 291,846 | ||||||||||||||||||||||||

Michael R. Cannon | 75,625 | (7) | 159,864 | (18) | 0 | 0 | 235,489 | 82,500 | (6) | 196,846 | — | 279,346 | ||||||||||||||||||||||||

Youssef A. El-Mansy | 60,124 | (8) | 159,864 | (18) | 0 | 17,974 | 237,962 | 75,000 | (7) | 196,846 | 23,962 | 295,808 | ||||||||||||||||||||||||

Christine A. Heckart | 70,000 | (9) | 159,864 | (18) | 0 | 0 | 229,864 | 78,625 | (8) | 196,846 | — | 275,471 | ||||||||||||||||||||||||

Grant M. Inman | 97,500 | (10) | 159,864 | (18) | 0 | 17,974 | 275,338 | — | (9) | — | 23,962 | 23,962 | ||||||||||||||||||||||||

Catherine P. Lego | 85,000 | (11) | 159,864 | (18) | 0 | 13,000 | 257,864 | 90,875 | (10) | 196,846 | 22,748 | 310,469 | ||||||||||||||||||||||||

Kim E. Perdikou | 67,500 | (12) | 0 | 0 | 3,835 | 71,335 | ||||||||||||||||||||||||||||||

Krishna C. Saraswat | 55,829 | (13) | 159,864 | (18) | 0 | 0 | 215,693 | 65,000 | (11) | 196,846 | — | 261,846 | ||||||||||||||||||||||||

William R. Spivey | 65,204 | (14) | 159,864 | (18) | 0 | 17,974 | 243,043 | — | (12) | — | 23,962 | 23,962 | ||||||||||||||||||||||||

Abhijit Y. Talwalkar | 78,750 | (15) | 159,864 | (18) | 0 | 0 | 238,614 | 120,500 | (13) | 196,846 | — | 317,346 | ||||||||||||||||||||||||

Delbert A. Whitaker | 26,021 | (16) | 0 | 0 | 0 | 26,021 | ||||||||||||||||||||||||||||||

| (1) | The amounts shown in this column represent the grant date fair value of unvested |

| (2) | On November 6, 2015, each non-employee director who was on the board received an annual grant of 2,600 RSUs based on the $76.90 closing price of Lam’s common stock and the target value of $200,000, rounded down to the nearest 10 shares. |

| (3) | Represents the portion of medical, dental, and vision premiums paid by |

| (4) | Mr. |

| (5) |

| (6) | Mr. |

| Dr. El-Mansy received |

| (8) | Ms. Heckart received $78,625, representing her $65,000 annual retainer, $12,500 as a member of the audit committee, and $1,125 as a partial year member of the compensation committee. |

| (9) | Mr. Inman retired in November 2015. All payments to Mr. Inman for the relevant fiscal year were paid in the prior fiscal year period. |

| (10) |

| Dr. Saraswat received |

| Dr. Spivey |

| Mr. Talwalkar received |

|